Model Builder

Analyze financial statements and build valuation models in one place.

Benefits of the Model Builder:

- No coding required

- Build financial models using an intuitive visual interface

- Calculate your own metrics using extensive market data and financial statements

- Save models and reuse them across companies

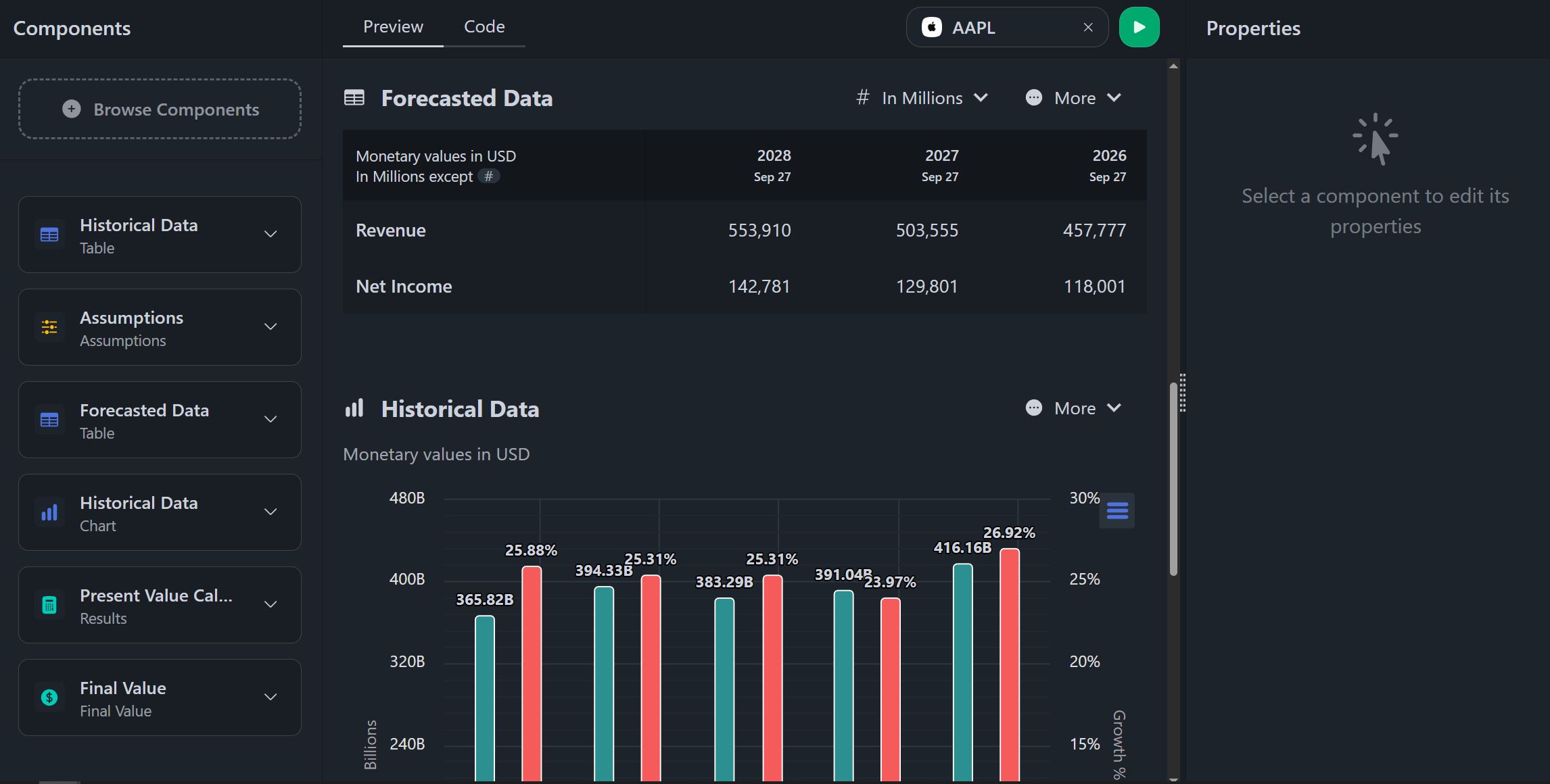

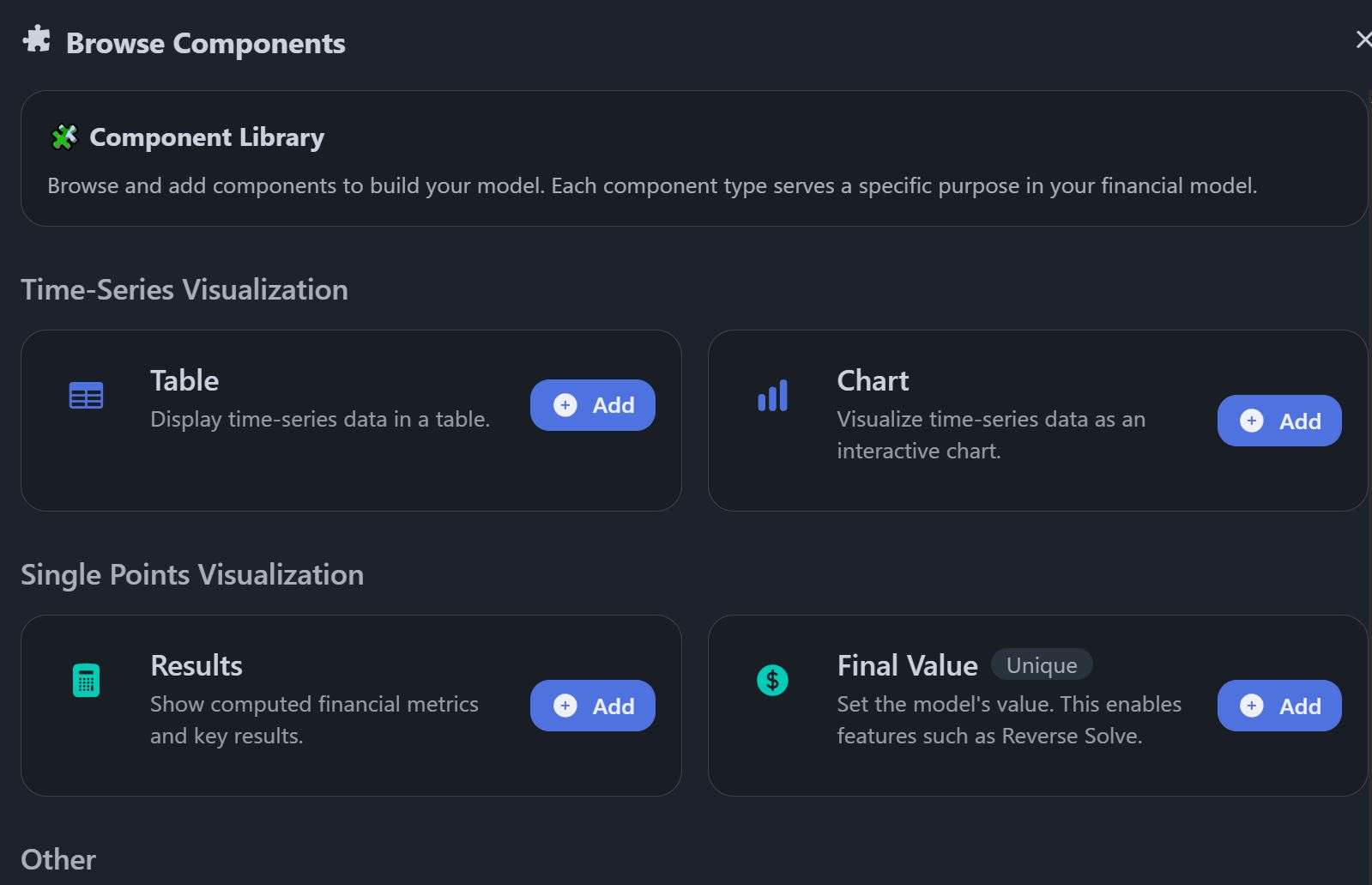

Build your model using components

You assemble a model by adding components and arranging them in the order you want.

- Tables and Charts display time-series data from financial statements and market data.

- Assumptions lets you define inputs (growth rates, margins, discount rates) and use them to forecast.

- Results and Final Value summarize your model and enable advanced workflows like Reverse Solve.

- Description is for notes and documentation, and Code Block is optional for advanced custom logic.

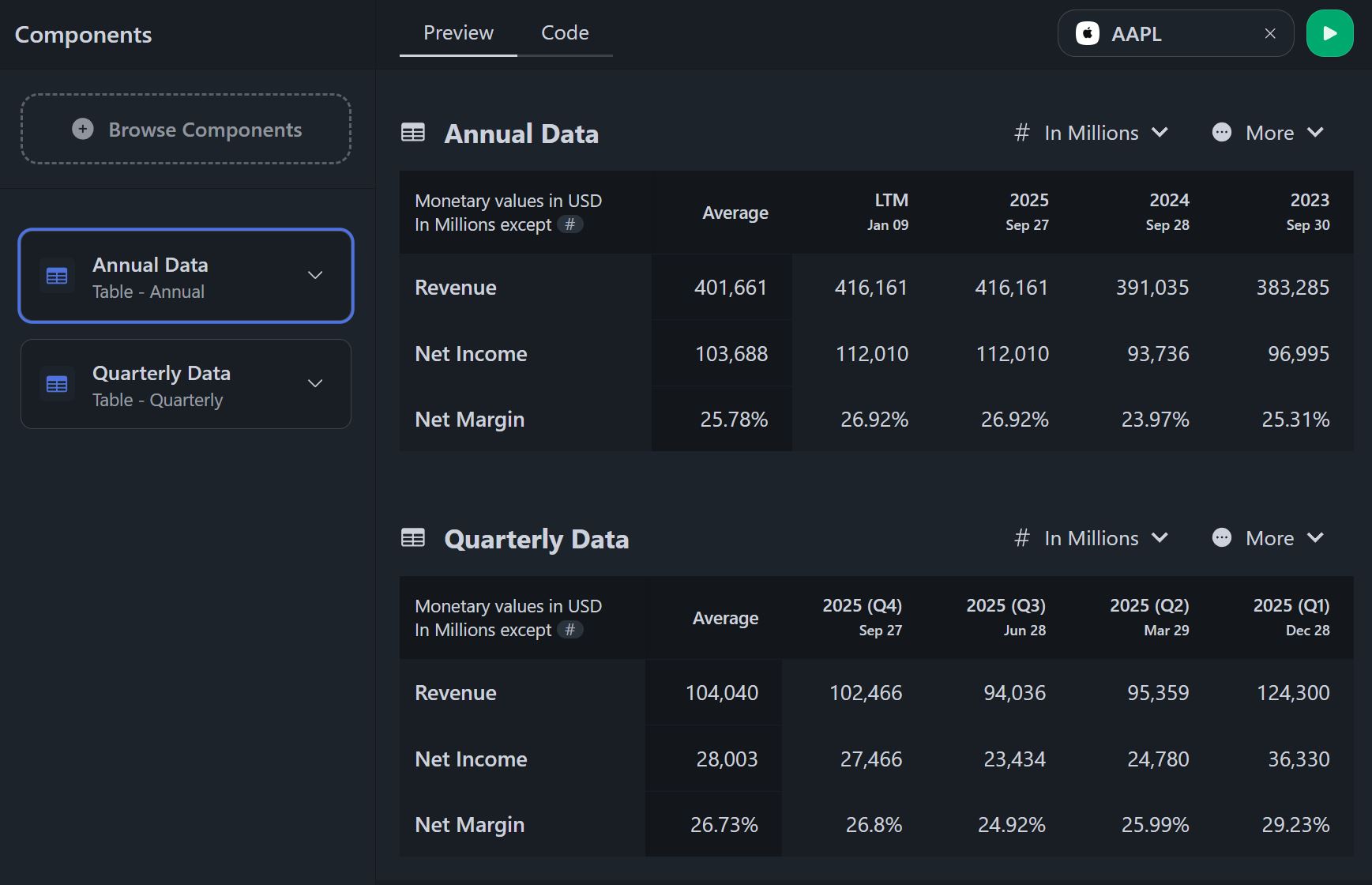

Annual and quarterly data

For time-series components, you can switch between annual and quarterly views.

In annual mode, you can also include LTM (last twelve months) for smoother, more up-to-date analysis.

This makes it easy to compare high-level trends with the most recent quarterly changes without leaving your model.

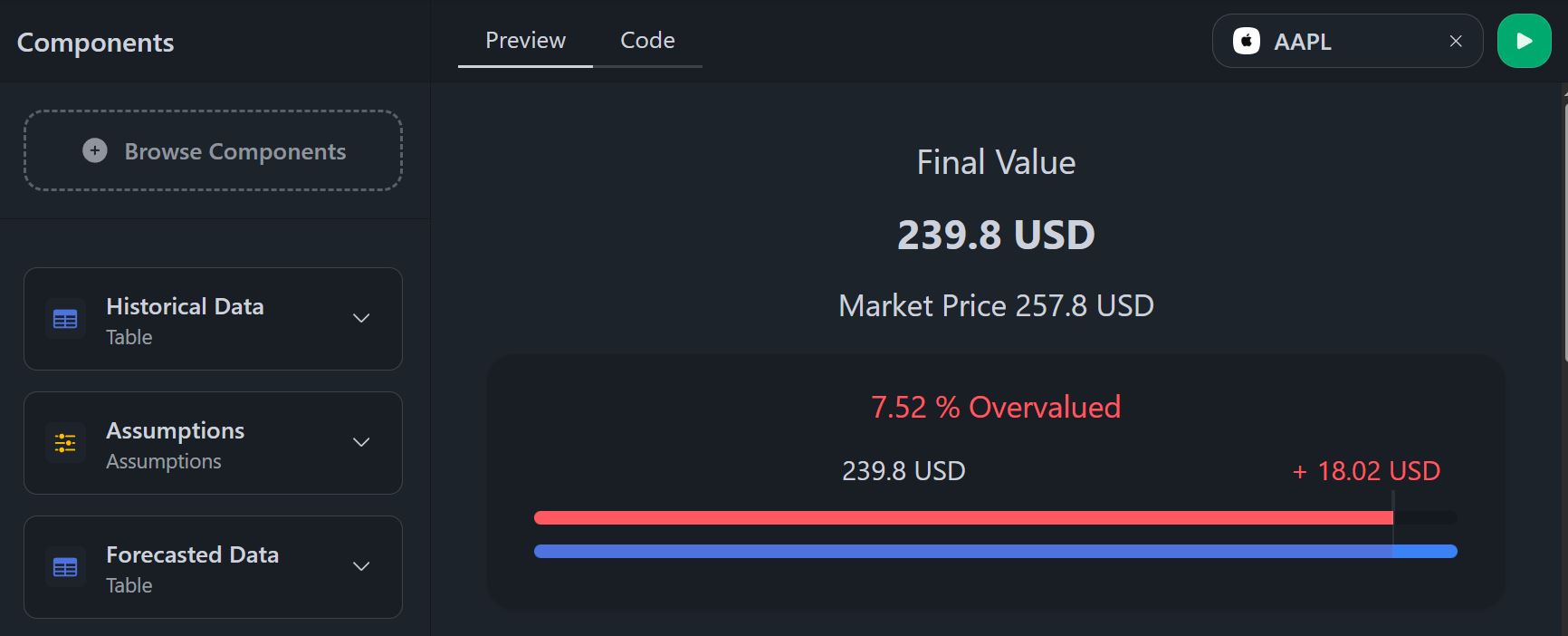

Custom metrics and forecasting

Use components to compute your own custom metrics (for example: margins, per-share values, and ratios specific to your strategy).

Combine Assumptions with statement data to build forecasts, then surface the outputs in Results.

When you set a Final Value, you can use Reverse Solve to find an assumption that matches a target valuation.